Finance Minister Bill Morneau’s message with Budget 2019 is that, thanks to the Federal Government’s investments over the past three years, things are going well — especially for the middle class: more Canadians have full-time jobs, unemployment is at historic lows, wages are growing, consumers and businesses are confident, economic growth is good, and our debt is manageable.

Nonetheless, says Morneau, more needs to be done to ensure Canadians’ prosperity over the coming years. For the most part, that means adding tax credits and other incentives and enhancing existing ones, giving the Canada Revenue Agency more resources to recover unpaid taxes and to help businesses comply, measures to reduce tax evasion and aggressive tax avoidance, improving retirement and disability savings plans, and introducing the framework for a national prescription drug plan.

It does not mean making changes to personal and business tax rates, making substantive effort to improve the efficiency of the Income Tax Act or making significant cuts intended to reduce the deficit.

Specific measures include:

- A new, non-taxable Canada Training Credit for eligible workers aged 25 to 64

- A new Employment Insurance Training Support Benefit

- Increasing the RRSP withdrawal limit under the First-Time Home Buyers’ Plan

- Preferred capital gains tax treatment for owners of multi-unit residential properties

- Increased access to the enhanced 35 per cent scientific research and experimental development tax credit

- Limits on the employee stock option deduction for large, long-established, mature companies

- Broadening the tax rules for certain registered plans to allow new types of annuities

- Changing the rules for Registered Disability Savings Plans to better protect the long-term savings of persons with disabilities

- Making zero-emission vehicles eligible for a 100 per cent capital cost allowance rate in the year they are put in use

- Reallocating the CRA’s resources to improve digital services, provide more timely resolution to taxpayers’ objections, and adding CRA auditors to help new unincorporated businesses understand their tax obligations and extending the program to incorporated businesses

- Making a permanent dedicated CRA telephone support line for technical questions from tax practitioners

- Increasing CRA staff to reduce the time it takes to process T1 post-filing adjustments

- New CRA audit teams to detect and pursue complex real estate transactions where parties have not paid the required taxes

- Making Tax-Free Savings Account holders jointly and severally liable with their financial institutions for tax owing when using those accounts to carry on business

In brief, the 2019 Budget includes $22.8 billion in new spending over the next five years. The government expects revenues to steadily increase by nearly $60 billion in 2023 and projects program spending to increase by $40 billion that year. Debt payments are projected to increase by $7 billion.

Based on these growth and spending assumptions, the government expects the federal deficit to increase to nearly $20 billion in 2019–2020 and 2020–21 and then decline to $9.8 billion at the end of the next five years.

BUSINESS INCOME TAX MEASURES

Scientific Research & Experimental Development (SR&ED)

Canadian-controlled private corporations (CCPCs) or associated groups of such corporations, are entitled to an enhanced (35 per cent vs 15 per cent) federal tax credit based on up to $3,000,000 of current SR&ED expenditures incurred in a taxation year (the “expenditure limit”), based on the following criteria:

- A full enhanced credit is available if the taxable income in the previous taxation year of the particular corporation or the associated group is $500,000 or

- $10 of the expenditure limit is lost (thereby eroding the enhanced credit) for every dollar of taxable income in the previous taxation year in excess of $500,000. The expenditure limit is reduced to zero if that taxable income exceeds $800,000.

The enhanced credit is also eroded if the corporation’s (or the group’s) “taxable capital employed in Canada” (essentially the aggregate of equity and debt) exceeds $10,000,000 and is eliminated if that taxable capital exceeds $50,000,000.

The Budget proposes to remove the erosion that is based on taxable income. This proposal would apply to taxation years that end on or after March 19, 2019.

Support for Canadian Journalism

The Budget proposes to introduce the following measures to support organizations that are “Qualified Canadian Journalism Organizations” (QCJOs).

Effective January 1, 2020, QCJOs will be allowed to register for tax-exempt status as “qualified donees” that can issue charitable receipts. A QCJO must be a corporation or trust whose activities relate exclusively to journalism, is controlled by arm’s-length persons and satisfies other conditions.

Retroactive to January 1, 2019, certain QCJOs will be eligible for a 25 per cent refundable tax credit on remuneration paid to eligible newsroom employees. The remuneration eligible for the credit will be capped at $55,000 per year per employee. The QCJO must be a corporation, partnership or trust primarily engaged in the production of original written news content. Corporations must meet additional criteria.

Canadian Film or Video Production Tax Credit

This 25 per cent refundable tax credit is generally available, within limits, to qualified corporations that incur qualified labor expenditures in connection with an eligible Canadian film or video production.

Retroactive to March 12, 2018, joint Canada/Belgium productions will qualify for the credit.

Small Business Deduction — Farming and Fishing

A CCPC is generally entitled to pay federal tax at the small business rate, which is currently 9 per cent, on its first $500,000 of income from an active business carried on in Canada, provided that the $500,000 threshold is not reduced, nor the income in question restricted, under various rules of the Income Tax Act. Where income is not eligible for the small business deduction, a federal corporate tax rate of 15 per cent would apply instead.

Enacted in 2016, one such restriction prohibits specified corporate income (SCI) of a CCPC from being taxed at the small business rate. SCI generally encompasses income that the CCPC derives from the provision of services or property to private corporations in which the CCPC or other certain persons hold a direct or indirect interest. However, since the inception of the SCI rules, certain income that a CCPC derives from sales to a farming or fishing cooperative corporation is excluded from the definition of SCI.

Budget 2019 proposes to broaden the above-mentioned exclusion from the SCI rules. In particular, the sale of the farming products or fishing catches would no longer need to be made to a farming or fishing cooperative corporation, but merely to an arm’s-length corporation.

This measure will apply to taxation years beginning after March 21, 2016.

Zero-Emission Vehicles

The Budget proposes to introduce a temporary enhanced first-year CCA rate of 100 per cent in respect of eligible zero-emission vehicles. These vehicles will be classified under one of two new CCA classes.

Class 54 will include zero-emission vehicles that would otherwise be included in Class 10 or 10.1. The amount on which CCA can be claimed is limited to a maximum of $55,000 plus sales taxes, per vehicle.

Class 55 will include zero-emission vehicles that would otherwise be included in Class 16.

This measure will apply to eligible zero-emission vehicles acquired on or after March 19, 2019, and that become available for use before 2028, subject to a phase-out for vehicles that become available for use after 2023. The taxpayer must claim the enhanced CCA for the taxation year in which the vehicle first becomes available for use.

The Budget proposes to amend the GST/HST rules to ensure consistency with these measures.

Character Conversion Transactions — Converting Income to Capital Gains

Capital gains are taxed at half the rate of regular income and typically at a substantially lower rate than dividend income. Consequently, where a choice is available without a change in risk, investors have a bias to earn capital gains.

In addition, an election is available to most Canadian investors to treat all Canadian securities as capital property. If one elects, all gains on dispositions of Canadian securities are treated as capital gains or losses from the year of election onwards.

To earn capital gains instead of income, taxpayers wishing to earn a return from a reference portfolio of investments (which could include both Canadian and foreign investments) that produce fully taxable income could, instead of holding the reference portfolio, enter into a derivative agreement (a forward purchase contract) to acquire Canadian securities at a future date at a specified price. The value of the Canadian securities to be acquired under the derivative agreement could be determined based on the returns that would have been realized on the reference portfolio. The investor would acquire the Canadian securities at the agreed price, then immediately sell the Canadian securities at their fair market value, realizing a capital gain or loss.

Before 2013, the mutual fund industry offered investment platforms that allowed investors to realize capital gains instead of income from underlying investments. This was accomplished using derivatives.

In 2013, legislation was enacted to treat gains from “derivative forward agreements” as income rather than capital gains. These are agreements for terms that exceeded 180 days and where the difference in the fair market value of the securities delivered on closing and the predetermined amount paid for those securities was derivative in nature — that is derived from some other reference portfolio or investment.

A “commercial transaction” exception to the derivative forward agreement rules was in place where the economic return was based on the performance of the actual property being purchased or sold in the future. This exception is needed so that normal commercial transactions such as business acquisitions were not caught.

The mutual fund industry has since developed structures that allowed the investor to acquire and sell the reference portfolio on closing. Since the return from the transaction was based on the reference portfolio, and it was the reference portfolio being sold, the gain was not “derived” from another portfolio — the commercial transaction exception applied. The disposition was still treated as a capital gain or loss.

The Budget proposes to deny the commercial transaction exception where it is reasonable to conclude that one of the main purposes of the series of transactions is to convert into a capital gain any income that would have been earned on the security during the period that the security is subject to the forward agreement.

The new rule applies to transactions/agreements entered into on or after March 19, 2019. Starting in 2020, it will also apply to agreements entered into prior to March 19, 2019.

PERSONAL MEASURES

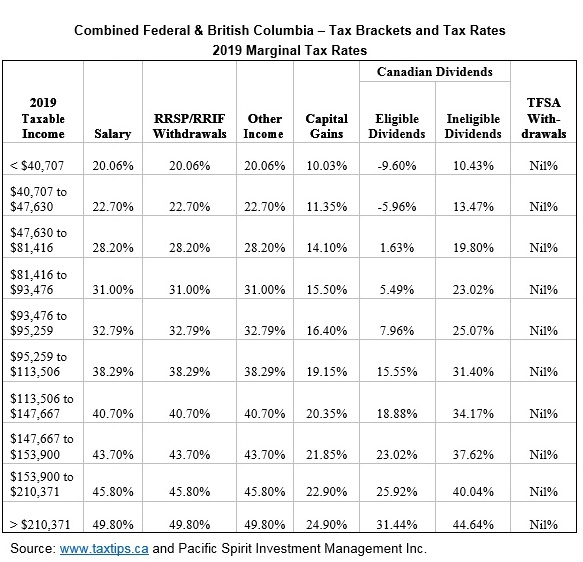

2019 BC Personal Marginal Tax rates

The personal income tax rates for 2019 are:

Employee Stock Options

Employee stock options can receive preferential tax treatment. The employee has a taxable employment benefit equal to the excess of the fair market value of the shares acquired at the exercise date over the price paid under the option. If certain conditions are met, the employee will be eligible for deduction of half the benefit effectively making the benefit half-taxable.

The Budget indicates the government’s intention to limit this preferential treatment (presumably the deduction for half the benefit). Specifically, the preferential treatment will only be available on shares acquired that fall under a cap for the year of grant. An annual cap of $200,000 has been set based on the fair market value of the shares that are the subject of the option. The Budget is silent on the date that the FMV is determined. It is intended that these changes would apply to employees of “large, long-established, mature firms.” Employees of start-up and rapidly growing businesses would be exempt from these rules.

The Budget indicates that further details would be released before the summer. The Budget papers do not include a proposed implementation date but do indicate that any new measures would not apply to options granted before the announcement of legislative proposals to implement any new regime.

RRSP Home Buyer’s Plan

Under the RRSP Home Buyer’s Plan (HBP), a first-time home buyer can borrow up to $25,000 from their RRSP to help finance the purchase or construction of a home. In order to qualify as a first-time home buyer, neither the individual nor their spouse can have owned a home in the year or any of the four preceding years. The four-year requirement is waived where the purchase is for a more accessible or suitable home that will be occupied by an individual eligible for the disability credit.

The Budget proposes to increase the maximum withdrawal per individual to $35,000 effective for withdrawals made after March 19, 2019.

The Budget also modifies the HBP rules to better accommodate marital breakdowns. The individual must be living separate and apart from their spouse, including a common-law partner, for a period of at least 90 days. The individual will be eligible to make a HBP withdrawal if the spouses live separate and apart at the time of the withdrawal and began to live separate and apart in the year of withdrawal or at any time in the four preceding years. However, if the individual is living in a home owned by a new spouse, they will not be able to use the HBP. This measure is effective after 2019.

Canada Training Credit

The Budget introduces the refundable Canada Training Credit (CTC). It is intended to provide financial support for professional development and training for working Canadians age 25 to 65. Eligible individuals will accumulate $250 per annum in a notional account which can be used to cover eligible training costs. The annual accumulation will start with the 2019 taxation year, with 2020 being the first year the CTC can be claimed.

In order to accumulate the $250 for a year, the individual must be age 25 to 64 at the end of the year, resident in Canada for the entire year, file a tax return for the year, have qualifying “working” income in the year of at least $10,000 (to be indexed annually) and have net income for tax purposes for the year of no more than the top of the third tax bracket for the year ($147,667 for 2019, indexed annually). Qualifying income includes employment income, self-employment income, maternity/parental Employment Insurance benefits and similar items. The $250 is still accumulated for years in which the CTC is claimed.

The amount of CTC that can be claimed will be the lesser of one-half of the eligible tuition and fees paid in respect of the year (generally those eligible for the tuition credit except that the educational institution must be in Canada) and the accumulated account balance at the beginning of the year. The individual will be able to claim the tuition credit on the eligible tuition and fees net of the CTC claimed. The individual must be resident in Canada throughout the year to be able to claim the CTC.

Kinship Care Providers

Some provinces/territories provide kinship care programs as alternatives to foster care or similar programs. Financial assistance may or may not be provided to defray the costs.

The Canada Workers Benefit (CWB) is a refundable credit available to low income workers. A higher benefit is available to couples and single parents. There was a concern that financial assistance under a kinship care program could preclude the caregiver from being considered the parent of a child for purposes of the CWB enhanced amount. The Budget proposes to clarify that the status of the child for the WCB is not impacted by kinship care financial assistance.

This measure is retroactive to 2009 and subsequent taxation years.

Social assistance payments made on the basis of a means, needs or income test, such as the Old Age Security Guaranteed Income Supplement, are not taxable but are included in income for purposes of determining eligibility for income-tested credits and benefits, for example the quarterly GST/HST credit. A concern was raised that kinship care payments could fall into this category, thereby potentially reducing credits and benefits available to lower income caregivers. The Budget proposes to clarify that kinship care assistance payments will not be included in income for the purposes of such credits and benefits.

This measure is retroactive to 2009 and subsequent taxation years.

Donations of Cultural Property

When cultural property is donated to a qualifying institution, the donor receives a charitable donation tax receipt for the full fair market value of the property but is exempt from tax on the capital gain that would otherwise be taxable on the disposition of the property.

In order to qualify for this treatment, the property must be certified under the Cultural Property Export and Import Act. In order to qualify, the property must be of “national importance” to such a degree that its loss to Canada would significantly diminish the national heritage. A recent court case interpreted this test to mean that a direct connection of the property with Canada’s cultural heritage must exist. As a result, there is a concern that significant works of art of foreign origin, such as an “old masters” painting, would not be certified and thus not eligible for the preferential donation treatment. To address this concern, the Budget proposes to eliminate the national-importance requirement for donations made on or after March 19, 2019.

Registered Disability Savings Plans

A Registered Disability Savings Plan (RDSP) is a vehicle intended to assist a family in providing for the long-term financial security of a family member eligible for the disability tax credit (DTC). There are special rules that apply where the beneficiary for whom the RDSP was established ceases to be eligible for the DTC.

Currently, when DTC eligibility ceases, no further contributions to the RDSP can be made and no further Canada disability savings grants and bonds can be paid into the plan. The RDSP must be collapsed by the end of the first year following the first full year of DTC ineligibility, unless an election is made to extend the RDSP’s life. The life can be extended for four years if a medical practitioner certifies in writing that the beneficiary will once again become eligible for the DTC in the foreseeable future. During the election period, no further contributions can be made or grants received, but withdrawals can be made under the normal rules.

The Budget proposes to relax these rules for 2021 and later years. The life of the RDSP will be able to be extended indefinitely and the requirement for medical practitioner certification eliminated. A rollover of a deceased individual’s RRSP or RRIF to the RDSP of a financially dependent infirm child or grandchild will be permitted, as long as the rollover occurs by the end of the fourth calendar year following the first full year of DTC ineligibility.

RDSPs will not be required to be collapsed after March 18, 2019, and before 2021 solely because the beneficiary has become ineligible for the DTC.

PENSION PLANS

Individual Pension Plans

Individual Pension Plans (IPPs) are defined-benefit pension plans that are intended to be an alternative to an RRSP for providing retirement benefits to the owner-manager. When an individual terminates membership in a defined-benefit pension plan, such as on termination of employment, a tax-deferred transfer of the commuted value of the member’s pension benefits is allowed. 100 per cent of the commuted value may be transferred to another defined-benefit plan or a prescribed portion (usually around 50 per cent) may be transferred to an RRSP.

Because of the greater amount that may be transferred to a registered pension plan (RPP), planning has developed making use of IPPs to circumvent the RRSP limitation. A new company is incorporated by the former plan member. This new company establishes an IPP to which the commuted value of the former pension benefits is transferred. The new company generally has no other purpose or activity.

The government considers this type of planning to be inappropriate. Accordingly, the Budget proposes that IPPs not be able to provide retirement benefits in respect of years of service under a defined-benefit plan of other than the company (or its predecessor) that established the IPP. Furthermore, assets transferred from a former employer’s defined benefit plan to an IPP that relate to such service will be required to be included in the income for tax purposes of the former plan member.

These measures are to apply to pensionable service credited under an IPP on or after March 19, 2019.

Permitting additional types of annuities under registered plans

The Budget proposes to permit two new types of annuities to be purchased under certain registered plans, subject to specified conditions. Firstly, “advanced life deferred annuities” (ALDAs) will be permitted, within limits, under a registered retirement savings plan, registered retirement income fund, deferred profit-sharing plan, pooled registered pension plan (PRPP), and defined-contribution registered pension plan. An ALDA is a life annuity whose commencement is deferred until the end of the year in which the annuitant turns 85. Secondly, “variable payment life annuities” (VPLAs) will be permitted under a PRPP and defined- contribution RPP. A VPLA is a life annuity whose payments vary based on the investment performance of the underlying annuities fund and the mortality experience of VLPA annuitants.

These measures will apply to the 2020 taxation year and beyond.

Specified Multi-Employer Pension Plans (SMEP)

The Budget proposes to prohibit contributions to a SMEP in respect of a plan member after the year in which that member’s 71st birthday occurs. A similar prohibition is proposed for contributions to a defined-benefit provision of the SMEP after the member has begun to receive a pension from the plan. These changes will bring SMEPs in line with the rules for other registered pension plans. The new rules will apply to contributions payable in respect of collective bargaining agreements concluded after 2019.

Digital Subscriptions Tax Credit

The Budget proposes a 15 per cent non-refundable tax credit on up to $500 of costs for eligible digital subscriptions per annum, resulting in a maximum $75 annual credit. To be eligible, the amounts must be paid to a Qualified Canadian Journalism Organization (QCJO) for a subscription to digital form content of a QCJO. The QCJO must be primarily engaged in producing written content. A subscription with a broadcaster will not qualify. The credit will be available for amounts paid after 2019 and before 2025.

Change in Use Rules for Multi-Unit Residential Properties

A taxpayer is deemed to have disposed of a property, or a part thereof, when its use is converted from income-earning to personal use, or vice versa. Under current rules, where the use of an entire property is converted to income-earning, or an income-earning property becomes a taxpayer’s principal residence, the taxpayer may elect to not have the deemed disposition occur in order to defer the taxation of any accrued capital gain until the time that the property is sold. In cases where only part of a property is converted, this election is unavailable.

The Budget proposes to extend the above-mentioned election to situations where only part of a property undergoes a change in use. For example, where a taxpayer owns a multi-unit residential property such as a triplex, if the taxpayer begins to live in one of the units previously rented, or vice versa, he or she can elect to not have the deemed disposition occur to that unit.

This measure will apply to changes in use that occur on or after March 19, 2019.

Medical Expense Tax Credit

Amounts paid for cannabis products may be eligible for the medical expense tax credit where such products are purchased for a patient for medical purposes in accordance with the regulations under the Controlled Drugs and Substances Act. As of October 17, 2018, cannabis is no longer regulated under this Act, but rather is subject to the Cannabis Regulations under the Cannabis Act.

The Budget proposes to amend the Income Tax Act to reflect the current regulations for accessing cannabis for medical purposes. This measure will apply to expenses incurred on or after October 17, 2018.

Carrying on Business in a Tax-Free Savings Account

A Tax-Free Savings Account (TFSA) is liable to pay tax under Part I of the Income Tax Act (at the top personal rate) on income from a business carried on by the TFSA or from non-qualified investments. Under the current rules, the trustee of the TFSA (i.e., a financial institution) is jointly and severally liable with the TFSA for Part I tax.

The Budget proposes to extend the joint and several liability for that tax owing on income from carrying on a business in a TFSA to the holder of the TFSA. The joint and several liability of a trustee of a TFSA at any time in respect of business income earned by a TFSA will be limited to the property held in the TFSA at that time plus the amount of all distributions of property from the TFSA on or after the date that the notice of assessment is sent.

This measure will apply to the 2019 and subsequent taxation years.

Mutual Funds: Allocation to Redeemers Methodology

A mutual fund trust may allocate its capital gains or ordinary income to its unit-holders and is entitled to a deduction in computing its income for the year. Where a mutual fund trust disposes of investments to fund a redemption of its units, a gain on the investment is realized by the trust and is subject to tax. The accrued gain may also be taxed in the hands of the unit-holder on the redemption of their units. To address this potential for “double tax,” a mutual fund trust has access to a capital gains refund mechanism under the Income Tax Act. This mechanism provides a refund to the mutual fund trust in respect of tax that the mutual fund trust has paid on its capital gains attributable to redeeming unit-holders. However, since this mechanism relies on a formula to approximate the tax, it does not always fully relieve “double taxation.”

The “allocation to redeemers methodology” was developed to more effectively match the capital gains realized by the mutual fund trust on its investments with the capital gains realized by the redeeming unit-holders on their units. This methodology allows a mutual fund trust to allocate its realized capital gains to a redeeming unit-holder and claim a deduction. The allocated capital gains are included in computing the redeeming unit-holder’s income, but its redemption proceeds are reduced by the same amount.

Deferral

Certain mutual fund trusts have been using the allocation to redeemers methodology to allocate capital gains to redeeming unit-holders in excess of the capital gain that would otherwise have been realized by these unit-holders on the redemption of their units. This results in a deferral of tax since the mutual fund trust is allowed a full deduction for the amount allocated but the redeeming unit- holder is taxed on the same gain as it would have realized had there been no allocation of income to them.

The Budget proposes to deny a mutual fund trust a deduction in respect of an allocation made to a unit-holder on a redemption of a unit of the mutual fund trust that is greater than the capital gain that would otherwise be realized by the unit-holder on the redemption, if the following conditions are met:

- The allocated amount is a capital gain; and

- The unit-holder’s redemption proceeds are reduced by the

This measure will apply to taxation years of mutual fund trusts that begin on or after March 19, 2019.

Character conversion

Certain mutual fund trusts have also been using the allocation to redeemers methodology to convert returns on an investment that would have the character of ordinary income to capital gains for their remaining unit-holders. This character conversion planning is possible when the redeeming unit- holders hold their units on income account, but other unit-holders hold their units on capital account. The Budget proposes to deny a mutual fund trust a deduction in respect of an allocation made to a unit-holder on a redemption if

- The allocated amount is ordinary income; and

- The unit-holder’s redemption proceeds are reduced by the

This measure will apply to taxation years of mutual fund trusts that begin on or after March 19, 2019.

INTERNATIONAL TAX MEASURES

Foreign Affiliate Dumping

Canada provides a participation exemption (exempt surplus) on repatriation of earnings from foreign affiliates. Canada simultaneously provides interest deductibility for amounts borrowed to invest in shares of foreign affiliates. Additionally, in our tax treaties, Canada typically requires five per cent or more withholding tax on dividends paid by Canadian companies to foreign parent corporations.

In the past, multinational parent companies wishing to extract surplus from a Canadian subsidiary could implement planning to sell or “dump” the shares of their non-Canadian subsidiaries to the corporation resident in Canada (CRIC) in exchange for cash and/or an interest-bearing vendor-take promissory note. The cash or promissory note paid was not subject to withholding tax. The interest on debt would shelter the taxable income of the Canadian operating company. Canada receives no withholding tax on the cash payment and reduced income tax on future business profit. Withholding tax would be collected if interest were paid on the vendor take-back note because the debt would be owed to a non-arm’s-length party.

Foreign Affiliate Dumping rules were announced in 2011 to combat the tax-free extraction of surplus when a CRIC that is controlled by a non-resident corporation, invests in a foreign affiliate. (Similar rules target loans made by a CRIC to non-arm’s-length non-resident members of a corporate group.)

These rules generally deem that where a foreign affiliate is acquired by a CRIC (or the CRIC makes a loan to a non-arm’s-length non-resident), either the cross-border paid-up capital of the CRIC is suppressed (ground down), or a dividend is deemed to have been paid by the CRIC to the foreign parent corporation.

Currently, the rules only apply where the CRIC is controlled by a foreign corporation or group of foreign corporations.

The Budget proposes to extend the rules to CRICs that are controlled by non-resident individuals and trusts or groups of persons that do not deal at arm’s-length with each other, that comprise any combination of non-resident corporations, individuals or trusts. For the purposes of determining if a non-resident trust is “related” and therefore not at arm’s-length with other parties, the trust will be deemed to be a corporation and the beneficiaries will be deemed to be shareholders that own shares pro-rata to the relative value of their beneficial interests in the trust.

Presumably the measure is aimed at CRICs that are owned by non-resident private equity funds or possibly high-net-worth families that structure their foreign-holding entities as trusts or partnerships rather than corporations.

This measure will apply to transactions or events that occur on or after March 19, 2019.

Transfer Pricing

Order of application of transfer-pricing rules

Transfer-pricing rules in the Income Tax Act generally provide that, where a Canadian taxpayer transacts with non-arm’s-length parties outside Canada, the price used for the transaction must be established using the arms’-length principle. That is, the parties must establish a price that is within the range that arms’-length third parties would have used had they transacted under the same terms and conditions.

The Income Tax Act contains other provisions which may require adjustment to the income reported on a transaction. Questions arose regarding whether adjustments were made pursuant to general transfer-pricing rules or other more specific provisions. In these situations, it was not clear whether transfer-pricing penalties were applicable.

The Budget proposes that the transfer-pricing adjustments shall apply in priority to any other adjustments required under the Act. Presumably, any applicable transfer-pricing penalties will apply in these situations.

Current exceptions to the transfer-pricing rules (for example subsection 17(8) which permits certain zero or low interest loans made to controlled foreign affiliates) are retained.

This measure applies to taxation years commencing after March 19, 2019.

Reassessment period for transfer-pricing “transactions”

The definition of “transaction” for transfer-pricing purposes is expanded beyond the normal meaning of that word.

The Income Tax Act provides an extended three-year reassessment period beyond the usual reassessment period for transfer-pricing adjustments. However, the definition of “transaction” for reassessment purposes was not the expanded definition used for transfer-pricing purposes. The Budget proposes to use the expanded definition of “transaction” in determining whether that transaction can be reassessed in the extended three-year reassessment period.

This measure applies to taxation years for which the normal reassessment period ends on or after March 19, 2019, meaning it applies to most transactions that have occurred in the last three to four years.

Base Erosion and Profit Shifting (BEPS) Update

No new legislative changes were announced related to BEPS. The government reaffirmed its commitment to actively participate in the OECD’s BEPS initiatives. Canada is participating in the review of the country-by-country reports first exchanged in 2018 with other governments and tax authorities. The review is expected to be complete in 2020.

The government reaffirmed its commitment to ratify and bring into force the Multilateral Convention to Implement Tax Treaty Related Measures to prevent BEPS (commonly known as the Multilateral Instrument or MLI).

Cross-Border Securities Lending

Securities lending occurs commonly in our capital markets, often seen when investors wish to short- sell securities that are expected to decrease in value.

A Canadian resident might borrow the shares of a public company from a non-resident lender. The Canadian would be required to make compensatory payments to the lender equal to any dividends paid on the borrowed shares and might be required to post collateral to secure the return of identical shares to the lender. If the borrowing is “fully” collateralized (defined to mean at least 95 per cent of the value of the borrowed security is collateralized with money or government debt obligations) the compensatory payment is considered a dividend and is subject to the normal dividend withholding taxes. When not fully collateralized, the compensatory payment is treated as a payment of interest, which is not subject to withholding tax if paid to arm’s-length parties.

The Act contains rules intended to ensure the lender is in the same tax position as if the securities had not been lent, including with regards to Canadian withholding taxes on compensatory payments.

Canadian Securities

Where the borrowed security is a share of a Canadian corporation, the Budget proposes to treat all compensatory payments as dividends (regardless of whether fully collateralized). Thus, the dividend withholding rules will come into effect.

Under these proposed rules, the “lender” is deemed to be the recipient of the dividend, the security issuer is deemed to be the payer of the dividend, and the lender is deemed to own less than 10 per cent of the votes and value of shares of the issuer, meaning that the five per cent withholding rate in many treaties will not be accessible and a higher (often 15 per cent) withholding rate will apply.

The Budget also expands the application of these rules to “specified securities lending arrangements,” a concept introduced in 2018 to prevent the creation of artificial losses.

Foreign Securities

Where the borrowed security is a share of a non-resident issuer (a foreign corporation), the current rules require withholding tax on the compensatory dividend payment. However, the non-resident lender would not have been subject to Canadian withholding tax on receipt of a dividend from the non-resident issuer corporation. As a relieving provision, the Budget proposes to expand the exemption for withholding (subsection 212.1(2.1)) to any dividend compensatory payment paid by a Canadian resident borrower to a non-resident lender where the arrangement is fully (95 per cent) collateralized.

These new rules apply to payments made after March 19, 2019. For securities loans in place on March 19, 2019, the amendments apply to compensatory payments made after September 2019.

SALES TAX AND EXCISE TAX MEASURES

Human Ova and In Vitro Embryos

Donated human ova and in vitro embryos are being used in assisted human reproduction procedures in Canada. The Budget propose to extend GST/HST relief for human ova and in vitro embryos. It is proposed that supplies and imports of human ova be relieved of the GST/HST and that imports of human in vitro embryos also be relieved of the GST/HST.

This measure applies to supplies and imports of human ova and to imports of human in vitro embryos made after March 19, 2019.

Foot-Care Devices Supplied by Order of a Podiatrist or Chiropodist

Certain foot care devices, such as orthopedic devices and anti-embolic stockings, are zero-rated and relieved from GST/HST when supplied on the written order of a physician, nurse, physiotherapist or occupational therapist. The Budget proposes to add licensed podiatrists and chiropodists to the list of practitioners on whose order supplies of foot-care devices are zero-rated.

This measure will apply to supplies of foot-care devices made after March 19, 2019.

Multidisciplinary Health-Care Services

Health-care services may be provided by a multidisciplinary health team of licensed health-care professionals consisting of a physician, an occupational therapist and a physiotherapist. When supplied separately, the services rendered by these health-care professionals would generally be exempt from GST/HST. Currently, there is no GST/HST provision that explicitly relieves the service of a multidisciplinary team that combines elements of the various practices.

The Budget proposes to exempt from the GST/HST, the supply of a service rendered by a team of health professionals, such as doctors, physiotherapists and occupational therapists, whose services are GST/HST-exempt when supplied separately. The exemption will apply where all or substantially all of the service is rendered by such health professionals acting within the scope of their profession.

This measure applies to supplies of multidisciplinary health services made after March 19, 2019.

Cannabis Taxation

Later this year, edible cannabis, cannabis extracts and cannabis topicals will be permitted for legal sale under the Cannabis Act. The Budget proposes to impose excise duties on these products (including cannabis oils) based on the quantity of tetrahydrocannabinol (THC) contained in the final product. The THC-based duty will be imposed at the time of packaging of a product and become payable when it is delivered to a non-cannabis licensee such as a provincial wholesaler, retailer or individual consumer. The combined federal-provincial territorial THC-based excise duty rate for cannabis edibles, cannabis extracts (including cannabis oils) and cannabis topicals is proposed to be $0.01 per milligram of total THC.

This measure will come into effect on May 1, 2019, subject to certain transitional rules.

ADMINISTRATIVE MATTERS

Electronic Demands for Information by CRA

Both the Income Tax Act and Excise Tax Act provide CRA the power to serve notice on taxpayers and non-residents that carry on business in Canada, requiring production of information, including foreign-based information. The CRA may also demand third-party information from institutions such as financial institutions. The current rules generally require the Minister to personally serve or to send by registered mail the notice demanding the information. The Budget proposes to permit the CRA to serve such notice electronically to a bank or credit union that has provided consent to receive such notices electronically.

These measures are applicable to both the Income Tax and Excise Tax Acts and come into force January 1, 2020.

PREVIOUSLY ANNOUNCED INCOME TAX MEASURES

Budget 2019 confirms the government’s intention to proceed with previously announced income tax measures. Some of the key measures are summarized below.

Measures from the Fall Economic Statement

In its November 21, 2018, Fall Economic Statement, the government announced several income tax measures.

Accelerated Investment Incentive

The Accelerated Investment Incentive was introduced to allow businesses in Canada that acquire capital property on or after November 21, 2018, but before 2028, to be eligible for an enhanced first- year CCA deduction. This incentive will not apply to Classes 53, 43.1, and 43.2, which will instead be eligible for full expensing as discussed below.

To qualify for the incentive, the property cannot have been previously owned by the taxpayer or a non-arm’s-length person, nor can it be transferred to the taxpayer on tax-deferred “rollover” basis.

In the year that a capital asset becomes available for use, the taxpayer will be able to deduct three times the CCA that would have been deductible in the absence of this measure. The mechanics to achieve this result entail the suspension of the half year rule and the application of 1.5 times the CCA rate that would have otherwise applied (i.e., twice the CCA base multiplied by 1.5 times the CCA rate is equal to 3 times the CCA deduction). The larger deduction in the first year is ultimately offset by smaller deductions in the future years.

This measure will be phased out for capital assets that become available for use after 2023, as follows.

For capital property that would normally be subject to the half-year rule and becomes available for use between 2024 and 2027, the half-year rule will still be suspended, but the normal CCA rate will apply. The result is twice the CCA deduction in the first year.

For capital property that would not normally be subject to the half-year rule, the enhanced CCA deduction will be equal to 1.25 times the normal first year deduction.

Full expensing for manufacturing and processing equipment

Canadian businesses will be able to deduct 100 per cent of the cost of machinery and equipment acquired on or after November 21, 2018, that is used to manufacture and process goods in Canada.

A phase-out will begin for assets that become available for use in 2024, where the first-year deduction is reduced to 75 per cent. In 2026, the first-year deduction is further reduced to 55 per cent. For assets that become available for use after 2027, this measure will not apply.

To qualify for the enhanced write-off, the asset cannot have been previously owned by the taxpayer or a non-arm’s-length person, nor can it be transferred to the taxpayer on tax-deferred “rollover” basis.

Full expensing for clean energy equipment

Specified clean energy equipment acquired on or after November 21, 2018, will be eligible for a 100 per cent deduction in the year that the asset becomes available for use in a business.

This measure will phase out in the exact same manner as the phase-out of the full expensing for manufacturing and processing equipment discussed above.

To qualify for the enhanced write-off, the asset cannot have been previously owned by the taxpayer or a non-arm’s-length person, nor can it be transferred to the taxpayer on a tax-deferred “rollover” basis.

Extension of mineral exploration tax credit

The 15 per cent Mineral Exploration Tax Credit is extended from March 31, 2019, to March 31, 2024. This credit applies to specified mineral exploration expenses incurred in Canada and renounced by a corporation to individual flow-through share investors.

Trusts — Reporting Requirements

Budget 2018 proposed extensive new reporting requirement for most family trusts, effective for returns required to be filed for 2021 taxation years.

Inter-generational Business Transfers

The government will continue its initiative to develop new proposals to ensure that inter-generational transfers of businesses are better accommodated under the tax system. Budget 2019 specifically mentions Canadian farmers and fishers, but adds that this initiative also applies to other types of business owners.