Dear Friends of Pacific Spirit,

General Principles

It will be worth reiterating, in the context of this letter, the nature of our philosophy of advice. Our experience has been that successful investing is goal-focused and planning-driven, while most of the failed investing we’ve observed was market-focused and performance-driven. Another way of making the same point is to tell you that the really successful investors we’ve known were acting continuously on a plan—tuning out the fads and fears of the moment—while the failing investors we’ve encountered were continually (and randomly) reacting to economic and market “news.”

Most of our clients—and we certainly include you in this generalization—are working on multi-decade and even multigenerational plans, for such important goals as education, retirement, and legacy. Current events in the economy and the markets are in that sense distractions of one sort or another. For this reason, we make no attempt to infer an investment policy from today’s or tomorrow’s headlines, but rather align clients’ portfolios with their most cherished long-term goals. We make no attempt to time markets, and we cannot – nor, we are convinced, can anyone else – consistently call short-term moves in the markets. In a nutshell, we are planners rather than prognosticators; investors rather than speculators. We believe our highest-value services are planning and behavioural coaching – helping clients avoid overreacting to market events both negative and positive – and identifying great companies and determining their intrinsic value.

Our essential principles of portfolio management in pursuit of our client’s most important goals are threefold: (1) The only benchmark we should care about is the one that indicates whether you are on track to accomplish your financial goals. (2) Risk should be measured as the probability that you won’t achieve your financial goals. And (3) investing should have the exclusive objective of minimizing that risk to the greatest extent practicable.

Once a plan has been established – and funded with the investments that seem historically best suited to its achievement – we very rarely recommend changing the asset mix beyond a regular rebalancing. In brief, our principle is: if your goals haven’t changed, don’t change the portfolio asset mix. Our unscientific sense is that the more often people change their portfolios, the worse their results become. You will note that our portfolio turnover historically has been very low. We agree with the Nobel Prize-winning behavioural economist Daniel Kahneman, when he said, “All of us would be better investors if we just made fewer decisions.”

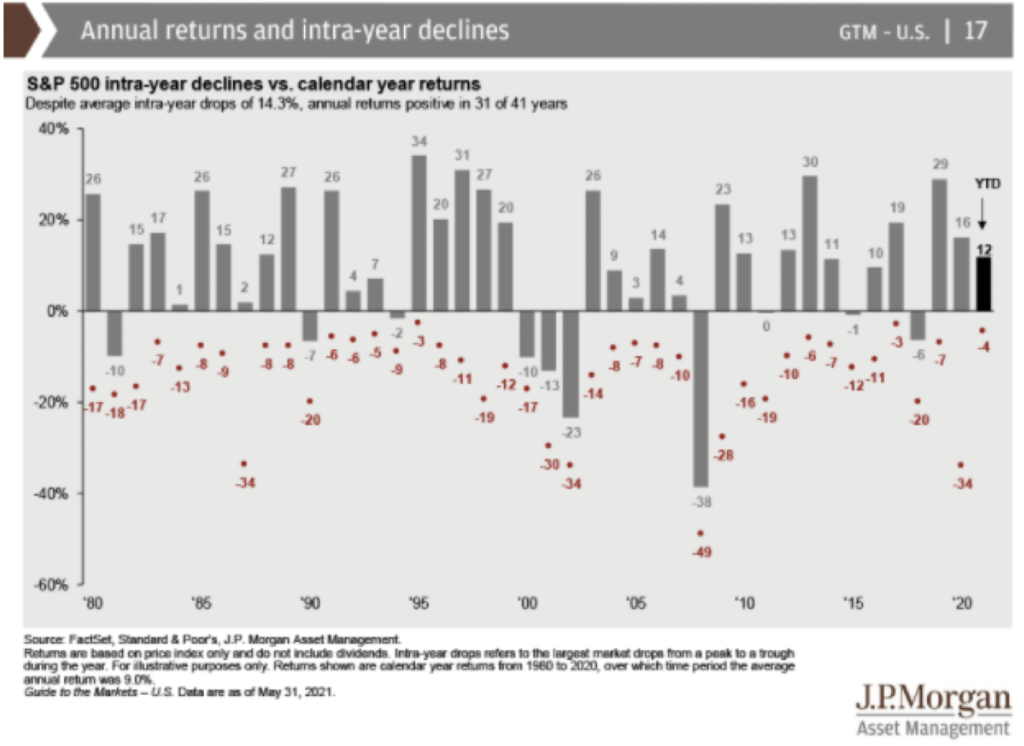

Going back to 1980, the average annual intra-year decline in the S&P 500 (an index that tracks the performance of the 500 largest publicly traded US companies) has exceeded fourteen percent.

Yet even without counting dividends, annual returns have been positive in 31 of these intervening 41 years, and the S&P 500 index has gone from 106 at the beginning of 1980 to 4,229.89 at the close on June 4, 2021. We believe the great lessons to be drawn from this data are that – historically, at least – temporary market declines have been very different from permanent loss of capital, and that the most effective antidote to volatility has simply been the passage of time. The nature of successful investing, as we see it, is the practice of rationality under uncertainty. We’ll never have all the information we want, in terms of what’s about to happen, because we invest in and for an essentially unknowable future. Therefore, we practice the principles of long-term investing that have most reliably yielded favourable long-term results over time: planning; a rational optimism based on experience, patience, and discipline. These will continue to be the fundamental building blocks of our investment advice in 2021 and beyond.

Current Observations

North American stock markets are at or close to all time highs. Rich equity valuations are an outcome of very low interest rates, expected strong corporate earnings growth over the next few years, a feeling in the financial sector that “the Fed has our back”, and a sense that equities are the only “game in town” with interest rates too low to make bond portfolios viable as a retirement funding vehicle. We know that forward price earnings ratio for the S&P 500 has been 16.7 over the past 25 years. Based on projected earnings of $194.89 for the year ending June 30, 2022 (Source: Standard & Poor’s as at 05.20.2021 as reported by the Prudent Speculator), the S&P 500 now has a forward price earnings ratio of 21.7. Rich indeed, but how can we make an investment policy from this information?

We can’t.

As Peter Lynch the famed manager of the Fidelity Magellan Fund once said, “I don’t believe in predicting markets. I believe in buying great companies – especially companies that are undervalued, and/or under appreciated.”

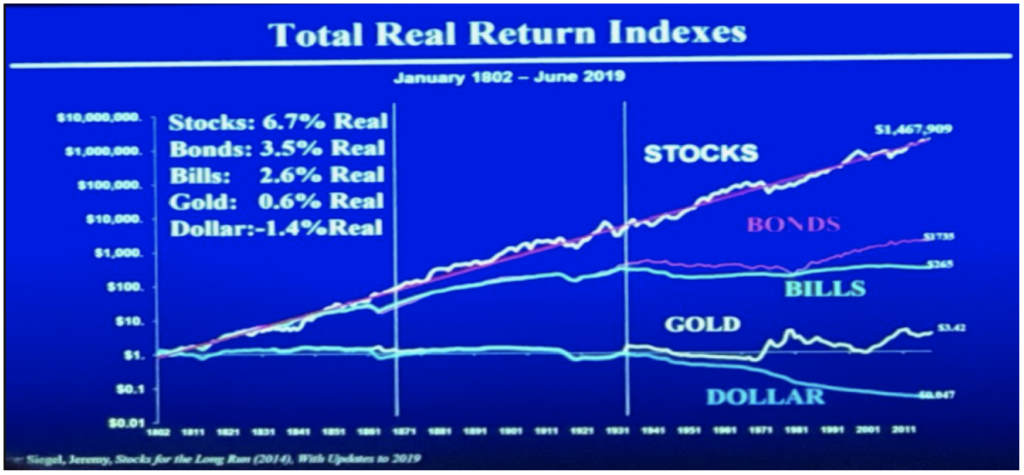

Dennis and I engaged in an exercise to predict market returns over the next seven years – a long enough period that the long-term trends identified by Jeremy Siegel in his book Stocks for the Long Run (and confirmed in other studies of long-term market returns) could be reasonably expected to influence the market. Seven years also is consistent with the long-term outlook for most of our clients, who have investment time horizons measured in decades – if not for themselves, then for their children, or their grandchildren.

Siegel found that the stock market follows a long-term trend line and that this trend line tracks the long-term growth of corporate earnings. Both corporate earnings and stock prices for the S&P 500 were found to grow 6.7% per year plus the rate of inflation (or as economists would say – a real return of 6.7% per year).

We are presently well above the long-term stocks trend line. If the market reverts to the trend line over the next seven years, we reasonably expect that an investment today in the S&P 500 would achieve a return of 4.0% per annum plus dividends, which presently are 1.38%; a total return of 5.38% per annum before any transaction costs, management fee, exchange rate fluctuations, etc. This is low compared to historical market returns, as it reflects the current valuation of the market.

We also ran another projection assuming interest rates remain low (compared to historical norms) justifying a higher price to earnings multiple. When we ran this model the projected return for the S&P 500 over the next seven years is 6.7% per annum plus dividends, so a total return of 8.08% per annum before any transaction costs, management fee, exchange rate fluctuations, etc.

On the fixed income side of the ledger the following rates are presently available in the market:

Government of Canada 3-month Treasury Bill 0.12%

Government of Canada 5 Year Bond 0.92%

Government of Canada 10 Year Bond 1.54%

The corporate bond pond that we have been fishing in for the past few years, where we are comfortable that we will receive interest payments on time and the principal at maturity, is still offering yields in the 4% to 5% per annum range, but bond prices are volatile and the pond is shrinking in size as companies are using this period of low interest rates to pay off and refinance their outstanding bonds at significantly lower interest rates.

In conclusion, equity returns over the next seven years will likely be lower than historical returns, but they will likely exceed fixed income returns. The dividend yield on the S&P 500 at 1.38% is higher than the yield on a 5-year government of Canada bond, and although the Government bond yield is fixed for 5 years – it won’t grow, even though inflation is gnawing away at the value of your investment daily – history has shown that corporate dividends grow at about 3 times the rate of inflation (Source: Dr. Asworth Damordaran, NYU Stern School of Business – as measured over the period 1960 to 2020).

So, this begs the question why an investor would hold bonds or other fixed income. Fixed income does have some very, very important roles in a portfolio. There are some investors who cannot handle the volatility of an all-equity portfolio. Fixed income is traditionally much less volatile asset class and may in fact rise in value when the equity market falls, providing a stabilizing influence on the portfolio. Also, the equity market has historically been down one year in four, so an investor seeking to draw cash from their portfolio in the short-term may want to have their funds in fixed income so they know that the money will be there when needed.

Are we worried about inflation? Yes, you can count on inflation returning. The US Federal Reserve has said that they want inflation of at least 2% per annum. They also said that they want to run the economy hot to pull the unemployed back into the workforce and give under-represented groups (women and minorities) an opportunity to participate in the economy. The Fed gets what the Fed wants. History has shown that over the long-term the equity market produces strong positive returns over and above inflation. Siegel showed that equity markets trend to a long-term return of 6.7% greater than the inflation rate.

Are we worried about higher interest rates? Yes, but the stock market has performed well during periods of rising interest rates. On the fixed income side of the portfolio, we are mitigating the risks of a return of inflation and higher interest rates by investing in shorter-term bonds, holding inflation-indexed or real-return bonds, and by investing in fixed income instruments that periodically reset their payments – higher as interest rates rise.

Are we worried about higher taxes? Yes, governments will have to finance their spending, but the stock market has performed admirably during periods of rising tax rates. We hope that you are sensing a theme here: Equity markets, although subject to volatility in the short-term (much of which is unpredictable), perform well over the long-term.

To reiterate, we practice the principles of long-term investing that have most reliably yielded favorable long-term results over time: planning; a rational optimism based on experience; patience and discipline. Investments should be married to the plan and the plan should be tailored to the individual client. This will continue to be the fundamental building blocks of our investment advice in 2021 and beyond.

Thank you, as always for being our valued client. Enjoy the summer!

Sincerely,

Pacific Spirit Investment Management Inc.

Please feel free to forward this commentary to anyone you feel would benefit from it.