On October 30, 2014, Prime Minister Stephen Harper proposed new tax relief and benefits for families effective for the years 2014 and 2015. The proposed new measures include:

Increase and Expansion to the Universal Child Care Benefit (UCCB)

As of January 1, 2015, parents will receive a benefit of $160 per month for each child under the age of six – this is an increase from $100 per month currently. Parents will receive up to $1,920 per child each year. Also as of January 1, 2015, parents will receive a benefit of $60 per month for children aged six through 17. Parents will receive up to $720 per child per year. The enhanced UCCB will replace the existing Child Tax Credit for 2015 and subsequent taxation years. Families will begin to receive payments under the enhanced UCCB in July 2015. The July UCCB payment will include up to six months of benefits to cover the period from January through June 2015.

Increase to the Universal Child Care Expense Deduction (UCCD)

Effective for the 2015 tax year, the maximum amount that may be claimed under the Child Care Expense Deduction will increase by $1,000. The maximum amounts that can be claimed will increase as follows:

| From | To | Criteria |

| $7,000 | $8,000 | Under age 7 |

| $4,000 | $5,000 | Aged 7 – 16 |

| $10,000 | $11,000 | Eligible for the Disability Tax Credit |

Family Tax Cut

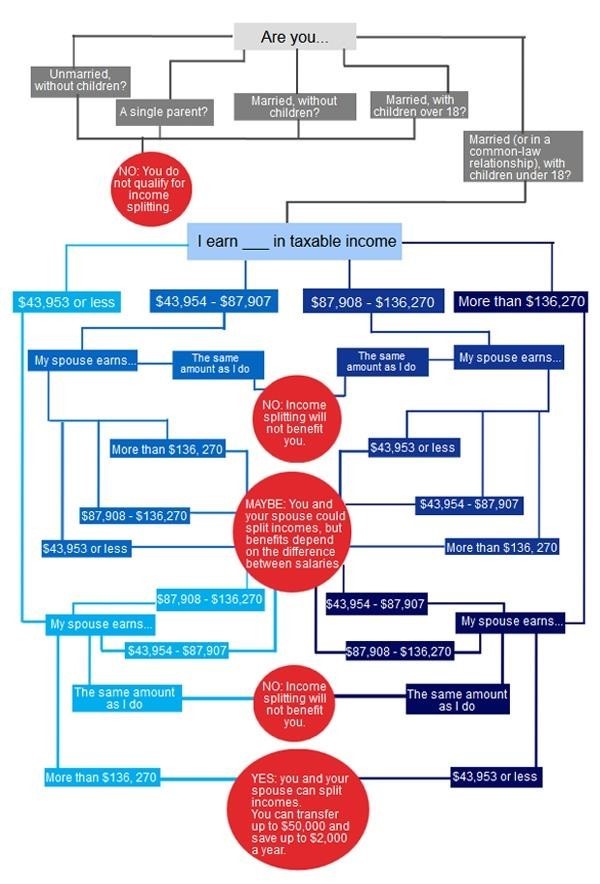

Under this proposed tax cut, a higher-income spouse will be allowed to transfer up to $50,000 of taxable income to a spouse in a lower tax bracket in order to receive a federal tax credit. The credit will provide tax relief – up to $2,000 per a family or a couple with children under the age of 18. Families can claim the Family Tax Cut in the spring of 2015 when they file their 2014 tax returns.

The graph below illustrates how the tax break will work:

Source: http://www.ctvnews.ca/politics/infographic-income-splitting-explained-in-easy-chart-1.2079969

We hope you find this information helpful. Our research was based on the information provided by Department of Finance Canada.

© Pacific Spirit Investment Management Inc., November, 2014. All rights reserved.