Dear Friends of Pacific Spirit,

We hope that you and your loved ones are doing well as we head into spring. Today, we are writing to provide you with a brief overview of some key market developments over the last quarter, and what to look forward to in the months ahead.

North American markets continued their march higher over the quarter, with the S&P 500 Index, a broad measure of blue-chip U.S. equities, finishing up 5.8%, with the Canadian S&P/TSX Composite Index up 7.3%, its fourth straight quarter of gains. Each of the TSX, S&P 500 and Dow Jones Industrial Average hit all-time highs during the quarter.

For just one three-month period, there was a lot to take in. We’ll begin with the largest factor impacting markets: the battle against COVID-19 and the economic ramifications tied to it. Even as vaccinations ramped up this quarter, there were (and continue to be) hiccups along the way. Numerous countries were forced back into lockdown, including many for the third time. Some nations who eased their restrictions too early were hit with record cases, and the U.S. topped its previous record high of COVID-19 hospitalizations and deaths. New variants have emerged, some are 30%-100% more deadly than previous strains.

The proliferation of vaccines has been a positive step, with many countries, including Canada, the U.S. and Germany, stating they believe all citizens who want at least one dose will have one by the end of summer. A large part of this optimism is due to the fast-tracked approvals of the vaccines. The overall pace of the rollout seems to be picking up speed, leading investors to consider what a resumption in economic activity will look like.

North American central banks continued to be accommodative in Q1, warning of the long-term negative effects of the virus and vowing to leave interest rates low for the foreseeable future. Even though the Bank of Canada announced it would begin winding down its existing liquidity programs, including those to buy provincial and corporate debt, it added that any tapering would be gradual. The U.S. Federal Reserve was more cautious, saying it did not see conditions that would lead them to taper back their asset-purchasing program for “some time.” Prime Minister Justin Trudeau announced that Canada would be extending its emergency rent and wage subsidies until June. U.S. President Joe Biden signed the much-discussed $1.9 trillion relief package into law, with $1,400 stimulus cheques to Americans included. He then presented an ambitious, $2.25 trillion, eight-year U.S. infrastructure plan at the end of the quarter.

As for the economic data that emerged in Q1, there is a sense of optimism as the world emerges from the damage of the pandemic. The Canadian government ran a deficit of $268.2 billion through the first 10 months of its fiscal year as Canada’s economy grew at an annualized rate of 9.6% over the last three months of 2020. In February, the country added 259,000 jobs, with the unemployment rate falling from 9.4% to 8.2%, the lowest since March 2020. Consumer confidence also rose to its highest in over a decade. In the U.S., inflation remains tempered, with the core consumer price index (CPI) growing 1.3% year-over-year. The US jobless rate was 6.2% as of quarter-end. Meanwhile, the European Union’s (EU) executive body said it expected growth in the 19 nations using the euro will reach 3.8% in 2021 and 2022, with growth in the full 27-nation EU said to hit 3.7% in 2021 and 3.9% next year.

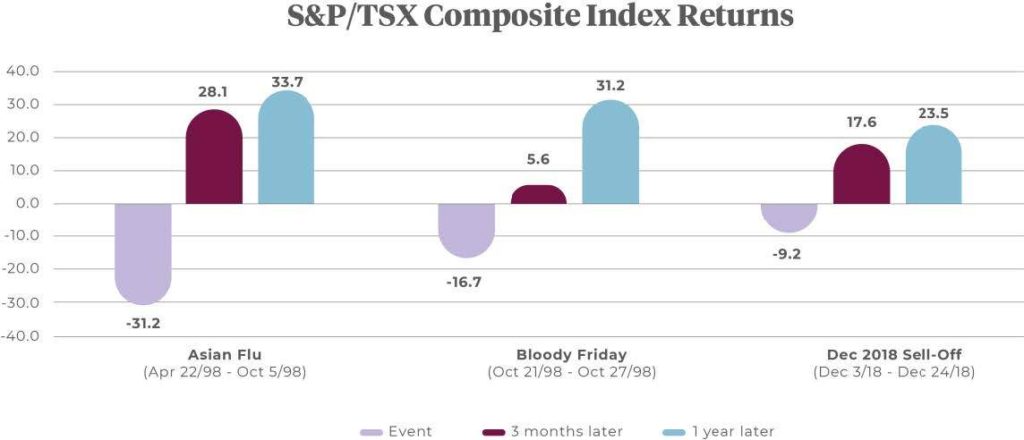

We can never be certain of how the future will play out, however experience with worrisome events in the past sheds some light as to what may be expected. While relevant to the market recovery we have seen throughout the pandemic, we are more interested in sharing this with you in the context of any future “crisis-like” situations.

Simply due to the ease with which news travels these days, the likelihood of hearing about more of these types of events continues to increase, whether they are a legitimate threat to markets or not. The news media and the markets react to the “apocalypse du jour,”and a natural reaction can be an urge to abandon your plan. Some of these items may be legitimately damaging to economies and markets, while others may just serve as a passing story, quickly forgotten. Regardless, what the data below demonstrates is that by simply sticking to your long-term plan, the consistent tendency is for returns to again move in your favour.

With the quantity of news we have had to digest in Q1 alone, we thought it helpful to have this reminder of the importance of sticking with your plan.

We expect that low interest rates and strong corporate earnings growth as the economy reopens will buoy equity markets. History has shown that as the economy emerges from recession earnings move forward at a robust pace. Current predictions are that corporate earnings will hit record highs in 2022. Moving forward into Q2 and the rest of 2021, the continued success of vaccinations and the gradual resumption of normal activity will take precedence in all facets of the news; be it how economies continue to recover, ongoing central bank and government support, or foreign relations.

In regards to the latter, ongoing tensions with China are likely to continue. The first quarter saw several unfriendly actions and even harsher words; this includes the delisting of Chinese telecommunications stocks on the New York Stock Exchange, a Canadian parliament motion saying China’s treatment of the Uighur Muslim minority in the Xinjiang region constitutes genocide, the trials of Chinese-detained Canadians Michael Kovrig and Michael Spavor, the sanctioning of Chinese officials by both countries, and more.

While large world powers fighting is never great news, Canada’s growing, unified stance with our neighbours to the south is encouraging. This includes President Biden’s agreement to start taking an “active role” in the release of “the two Michaels,” promises to work together on climate change, COVID-19 and the economic recovery, and the U.S.’ decision to send 1.5 million vaccine doses north. Having that relationship continue to strengthen should prove positive for both nations; ours in particular.

Yet no matter what transpires, we continue to advise you to remain committed to the long-term plan we have constructed together, one built for the ups and downs that every quarter brings. Q1 reinforced just how many challenging stories we will face over a lifetime of investing. Don’t doubt that we’ll get more – if not always so dramatic – opportunities to practice patience and discipline in the years to come. Successful investing remains fairly simple – make a goal focused plan and stick to it – but it is never easy. By focusing on the road ahead instead of the cobbles and speed bumps that may be in our path, we can continue to move to your ultimate goals.

We are always happy to discuss your investment plans if you feel it would be beneficial. If you have any questions, please call us or email us at johnsclark@pacificspirit.ca.

Pacific Spirit is Proud to Sponsor The Lost Seahorse Film

Pacific Spirit is pleased to be the lead sponsor of the film, The Lost Seahorse, which is being produced by a group of very talented 4th year Film students at Ryerson University.

The Lost Seahorse is a charming adventure story with a melancholy ending that will make audiences reflect on the ecological damage we have inflicted on the ocean. Despite only occupying 1% of the ocean, coral reefs make up 25% of the ocean’s biodiversity and are home to millions of unique sea creatures. Rising temperatures and ocean acidification are causing these corals to bleach. This is a global crisis. It is more vital than ever that we address this issue, or coral reefs will have no chance of recovering. While The Lost Seahorse focuses on the journey of a single creature, the film’s ecological message applies to all our oceans.

The film’s Facebook page is here: https://www.facebook.com/thelostseahorsefilm

We encourage you to visit the page and see the tremendous work these student storytellers are doing.

Our Offer

You may have a relative, friend, or colleague who did not have a productive investment experience during the pandemic, the ensuing recession, and the bitterly contested US election – who may benefit from the sort of approach to long-term investing that we are pursuing.

Should that be the case, we would certainly appreciate you introducing us. We very much enjoy working with you and would welcome the opportunity to offer the same level of planning and service to people you care about. We have been blessed with wonderful clients and we have found, as our practice has grown, that wonderful people surround themselves with like people.

Thank you, as always for being our valued client.

Sincerely,

Pacific Spirit Investment Management Inc.